Your Trusted Property Partner

History has shown us that courage can be contagious - Michelle Obama

Trying to decide whether to buy an existing home or to build is tough. An existing home will probably come with a landscaped garden, services installed, and all fitting decisions already made. If the Deeds Office does its thing, the transfer should be a relatively quick process from the moment your offer to purchase is accepted.

But there are benefits in other approaches too, notes Paul Stevens, CEO of Just Property.

There are a number of positives to buying a plot of land and building your dream home. You’ll save on transfer duty and can claim depreciation when it comes to taxes. The home will be built to your exact specifications, and you have the option to include modern energy and water-saving technology, internet connectivity/WiFi and more.

You won’t have the maintenance headaches that some older homes come with or have to spend extra to fix the previous owner’s questionable taste in bathroom tiles and other fittings.

Building, on the other hand, obviously takes a lot of time, and that’s once you’ve found a plot. Vacant land is not always easy to find if you’re hoping to live in a specific neighbourhood, say, near the schools your children attend.

Then you need to appoint an architect, get the plans drawn up and approved, choose a builder, possibly have the electrical and plumbing services installed, decide on materials and choose your fittings, deal with the mess, and possibly need to rent somewhere if the job runs overtime.

At the end of the day, it comes down to your budget. As the gurus at EstimationQS say, “Building and property development is a complex process that needs careful planning and realistic cost projections to get value out of your investments and hard-earned money.”

EstimationQS is a blog updated by qualified Construction Estimators and Quantity Surveying Technicians aimed at providing information and guidance to clients and property developers planning a construction project.

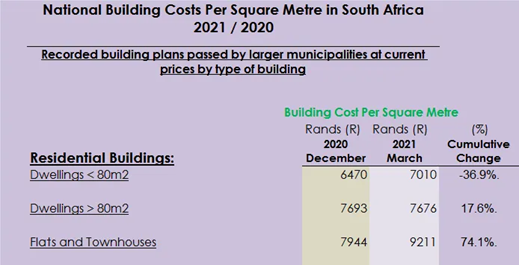

Using the Stats SA building survey data, they have published the average building cost per square metre based on recorded building plans passed by larger municipalities.

Building costs have risen in the past year across all dwellings above 80m². The average cost of renovations stayed almost the same and is currently at R7 842/m².

Look at what plots are going for in areas you like and subtract the average cost from your budget. Now using the figures above, work out roughly how much house you can build with what you have left. Finally, research homes for sale and developments being marketed in areas you like and compare them with the cost to build to see what your best option is likely to be.

If that sounds stressful (and it usually is), but you really want a brand-new home, you could buy off-plan in a development. This avoids transfer duties, all services are supplied, and the developers often work with mortgage originators to offer really excellent deals.

You can usually still choose your own fittings, and often added extras, such as appliances, are included in the cost. PLUS, if you commit early before ground has been broken, you could make a significant profit once the development is complete.

But, there are other considerations here too. Paul Stevens, CEO of Just Property, highlights the importance of checking the credentials of the developer before signing anything. He suggests some ways to achieve that:

• Find out if they have a professional website that contains key details about the developer and the project. La Palmera is a good example; it has a price list, development features, a site development plan, unit types, location, affordability and contact details.

• Visit other developments (or phases of the development you are interested in) that the developer has been involved with and talk to people who have worked on other projects with him/ her – the track record will speak for itself. Ask whether the developments were completed on time and to a reliably high standard.

• Ask questions about the developer’s ways of working and contractual terms. For example, how are proposed deviations from the approved plans handled? Where are deposits held (it should in in Trust)? How is interest on those developments handled? What are the payment terms, date of possession and the penalty in case of delayed possession?

• Ask for evidence of the developer’s financial backing and partnerships with bond originators/ banks that demonstrate their confidence in the development. If credible lenders are prepared to back the development, you can be more confident about your own investment in it.

Evaluate your personal goals, the timelines you can commit to achieving them, as well as your appetite for the pain points and benefits associated with each option carefully. This is a big commitment with a long-term impact. Stevens concludes, “a professional real estate agent should help you navigate this decision objectively, so ask lots of questions and tap into their insights and expertise”.

The original article can be viewed here.

Other Article: Renting vs buying property in South Africa right now: 14 November 2020

Dormehl Phalane Property Group Overstrand, part of a leading national estate agency franchise, is a popular choice for property services in Gansbaai. Specialising in residential property transactions, Dormehl Phalane Property Group Overstrand maintains a well-connected database of homes and prospect...

View ProfileXplorio is your local connection allowing you to find anything and everything about a town.

Read MoreHistory has shown us that courage can be contagious - Michelle Obama

Buying for the first time? We’re here to walk you through it all.

Why did the property practitioner bring a ladder to the open house?

Thinking of buying or selling? 𝗞𝗻𝗼𝗰𝗸 𝗼𝗻 𝘁𝗵𝗲 𝗯𝗹𝘂𝗲 𝗱𝗼𝗼𝗿 𝗳𝗶𝗿𝘀𝘁.

When you’re in the process of buying or selling a property, you may find yourself wondering why your real estate agent needs so many personal details.